OIL PRICE INTELLIGENCE REPORT

In today’s newsletter, we will take a quick look at some of the critical figures and data in the energy markets this week.

We will then look at some of the key market movers early this week before providing you with the latest analysis of the top news events taking place in the global energy complex over the past few days. We hope you enjoy.

Investor Alert! Oilfield service giants are looking like an increasingly good investment as oil prices rebound. Read our latest Global Energy Alert investment column to get the full breakdown of what to watch...

Chart of the Week

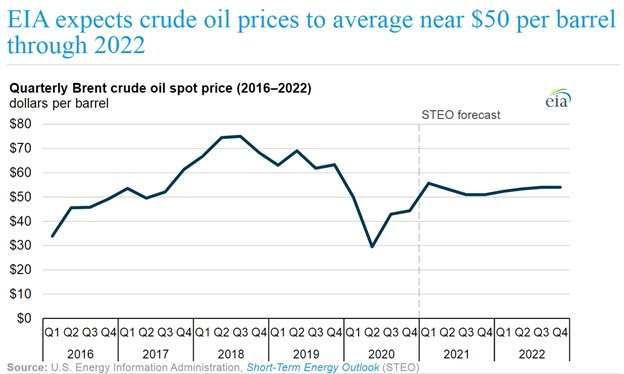

- The EIA expects global oil demand to be larger than supply in 2021, particularly in the first quarter, leading to sharp inventory drawdowns.

- EIA projects Brent to average $56 per barrel in the first quarter.

- However, the agency expects Brent to remain stuck between $51 and $54 on a quarterly basis through 2022.

Market Movers

- Hess (NYSE: HES) said it would spend $1.9 billion in 2021, 80% of which would be concentrated in Guyana and the Bakken.

- Russian vessel Fortuna started working on the last section of the Nord Stream 2 pipeline in Danish waters, despite U.S. sanctions.

- ExxonMobil (NYSE: XOM) lifted force majeure on Qua Iboe crude exports in Nigeria for the first time in six weeks.

Tuesday, January 26, 2021

Oil prices fell at the start of the week on growing concerns related to demand. China is encouraging its population not to travel over the Lunar New Year period due to new Covid-19 cases, a time when millions of people travel.

BP cuts exploration team. BP’s (NYSE: BP) exploration team is down to less than 100 people, from over 700 a few years ago. “The winds have turned very chilly in the exploration team since Looney’s arrival. This is happening incredibly fast,” a senior member of the team told Reuters.

Oil majors slow exploration. It isn’t just BP. In 2020, the five largest western oil majors dramatically reduced the number of drilling licenses they acquired. Analysts say as a result of the cutbacks in acquired licenses, production in the second half of the decade will be significantly impacted.

Oil industry alarmed at drilling restrictions. The Biden administration may suspend new leases on federal lands – the administration already issued a 60-day moratorium – sending the stock prices of oil drillers tumbling. New Mexico may have a lot to lose. However, the industry has already stockpiled permits that could take years to work through, so the practical impact may be limited.

Drilling restrictions bullish for oil. “[P]olicies to support energy demand but restrict hydrocarbon production (or increase costs of drilling and financing) will prove inflationary in coming years given the still negligible share of transportation demand coming from EVs (and renewables),” Goldman Sachs wrote in a report.

Keystone XL cancellation bolsters TMX. The Trans Mountain expansion project has just become the most important oil pipeline project in Canada after U.S. President Joe Biden stopped the U.S.-Canada cross-border link Keystone XL. The project is “really the only practical option left for increasing pipeline takeaway capacity and there should be a clear statement from the federal government that they’re committed to its completion,” said Dennis McConaghy, a former executive vice-president of Keystone developer TC Energy.

Morgan Stanley: LNG shortfall by 2023. Morgan Stanley said that the global market for LNG is tightening. Recent price spikes are temporary, but the bank said that there could be a supply shortfall by 2023. The report said that the Covid-related knocked off 15% of expected global supply through 2025, but demand only fell by 3%. “While the recent price spike has left summer ’21 prices over-extended, creating some near-term price risk to the downside, a new multiyear up-cycle has likely begun,” the report said. As a result LNG prices could double between 2020 and 2023.

$50 billion worth of gas projects at risk. Volatile LNG prices are putting $50 billion worth of gas-fired power plants in Asia at risk.

IEA: Global gas demand up 2.8% in 2021. In its first-ever quarterly gas report, the IEA said that global gas demand would bounce back this year, erasing losses from 2020. “Global gas demand is expected to recover in 2021 from an unprecedented drop in 2020,” the IEA said.

WoodMac: Solar least-cost option by 2030. The costs of solar will fall by another 15-25% over the next decade, making solar the least cost form of power generation in all 50 states by 2030, according to a new study by Wood Mackenzie.

Equinor divests from Canada’s oil sands. Equinor (NYSE: EQNR) sold its 18.8% stake in Athabasca Oil, completing its total exit from onshore Canada.

Indonesia seizes Iran oil tanker. Indonesia seized an Iranian-flagged oil tanker over a suspected illegal oil transfer.

Shell to buy largest UK EV recharging network. Royal Dutch Shell (NYSE: RDS.A) said it would buy the largest network of EV recharging stations in the UK.

Biden to electrify government fleet. President Biden said that the federal government will be a major purchaser of electric vehicles. The U.S. government has 645,000 vehicles in 2019, which consumed 375 million gallons of gasoline and diesel.

China to struggle with shale gas. China’s oil majors will struggle to ratchet up shale gas production beyond 2025, according to Reuters. Geological complexity and high costs could lead to slow growth, which may mean a greater reliance on imported LNG.

Refiners set for rough quarter. With earnings reports soon to be unveiled, refiners are bracing for another rough quarter. Seven independent U.S. refiners are expected to post an average earnings-per-share loss of $1.51, worse than the $1.06 loss in the third quarter, according to IBES data.

Renewables surpass fossil fuels in EU. Renewable energy overtook fossil fuels as the European Union’s largest source of electricity for the first time in 2020. Renewables accounted for 38%, with coal and gas combined at 37%.

NextEra posts loss on Mountain Valley impairment. NextEra Energy (NYSE: NEE) posted a fourth-quarter loss after writing down $1.2 billion related to the Mountain Valley pipeline, which suffered a legal setback recently, potentially leading to “substantial delays” in its start up.

Sumitomo ends work on new oil projects. Sumitomo Corporation said that it would not start any new oil projects in an effort to pivot away from fossil fuels.

Oil supertankers to be sold for scrap. A surplus of oil supertankers due to overbuilding and because of weak oil demand means that a growing number will be broken down and sold for scrap.

EVs near “tipping point.” Experts say that EVs are close to a “tipping point” of mass adoption due to falling costs. EV sales increased by 43% globally last year. Price parity with the internal combustion engine on an unsubsidized basis is expected between 2023 and 2025.

EU greenlights $3.5 billion battery project. EU regulators gave the go-ahead to a $3.5 billion battery project spearheaded by a dozen European countries.

New York divests $4 billion from fossil fuels. New York City’s Comptroller announced that the City’s pension funds would divest their portfolios from fossil fuels. The $4 billion divestment is one of the largest in the world to date.

BlackRock’s Larry Fink calls for net-zero plans. BlackRock’s CEO Larry Fink is set to call on the corporate world to “disclose a plan for how their business model will be compatible with a net-zero economy.” Fink’s annual letter to corporate leaders is widely viewed as a barometer for investment trends in financial markets.

Comentarios