OIL & ENERGY INSIDER

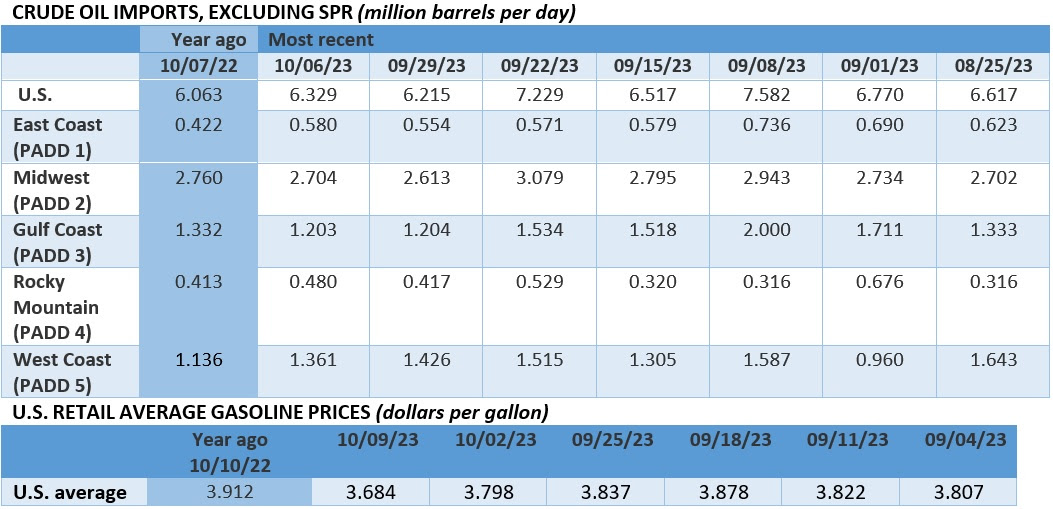

While oil prices had fallen back after soaring at the start of the week, signs that the U.S. is set to step up its sanctions action against both Russia and Iran have boosted prices, with Brent now nearing $90.

Friday, October 13th, 2023

The sanctions hammer wielded by the Biden administration this week has been inadvertently supporting oil prices, with ICE Brent set to finish this week at 88 per barrel, an unlikely prospect given the huge US inventory builds reported mid-week. However, a pledged ramp-up in Russia’s oil price cap enforcement, kicked off with two sanctioned tankers, and an increasing market expectation that there will be more sanctions on Iran amidst the Israel-Palestine standoff has heightened geopolitical risks and brought the $90 per barrel mark closer again.

Exxon Merges with Pioneer, Creating US Shale Giant. ExxonMobil’s (NYSE:XOM) purchase of US shale rival Pioneer Natural Resources (NYSE:PXD) in an all-stock deal valued at $59.5 billion propels Exxon to become the largest Permian producer, with the deal expected to close in early 2024.

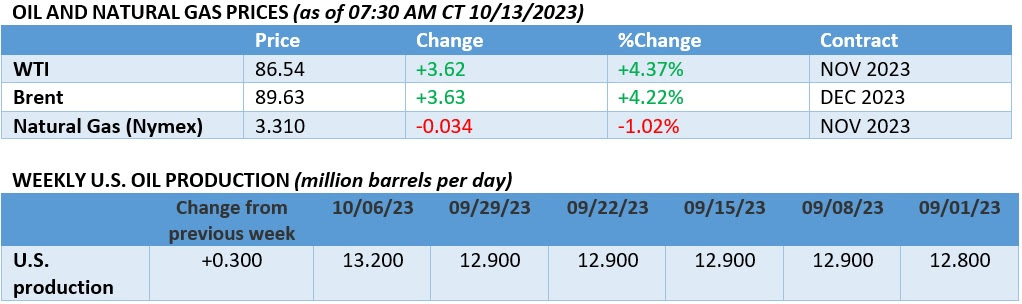

EIA Lowers 2024 US Production Outlook. The US Energy Information Administration lowered its output forecast for 2024 to 13.12 million b/d, down 40,000 b/d compared to the previous issue of the STEO, all the while hiking its WTI forecast by almost 8 per barrel to $90.91 per barrel annual average.

India Courts Saudi Arabia to Boost Its SPR. India wants Saudi Arabia’s national oil company Saudi Aramco (TADAWUL:2222) to participate in its upcoming 6.5 million tonnes buildout of strategic petroleum reserves, eyeing the construction of two new storage tank farms across India.

Japan Launches Its Own Carbon Trading Scheme. The Tokyo Stock Exchange started trading Japanese carbon credits this week, combining emissions trading starting next year and a carbon levy starting in 2029, with the world’s fifth-largest carbon emitter seeking to achieve net zero by 2050.

Qatar Inks Multi-Billion LNG Deal with France. QatarEnergy signed a 27-year term deal with French major TotalEnergies (NYSE:TTE) to supply up to 3.5 million tonnes per year of LNG from its North Field East and North Field South expansion projects, delivered on an ex-ship basis to the Fos terminal.

US Sanctions Russia Cap-Defying Tankers. The Biden administration slapped sanctions on two tanker owners that allegedly carried Russian oil above the G7 price cap of $60 per barrel, one based in Turkey and the other in the UAE, seeking to close loopholes in its sanctions mechanisms.

Egypt LNG Export Suffer as Israeli Flows Halted. US oil major Chevron (NYSE:CVX) has halted natural gas exports through the East Mediterranean Gas pipeline to Egypt where production from the Tamar gas field was routinely exported as LNG, jeopardizing the seasonal restart of Egyptian LNG flows.

Diesel Stock Increases Soften Shortage Fears. Distillate inventories in the US, Europe, and Singapore have increased month-on-month in September, although the U.S. is 21 million barrels below the seasonal average and Europe is 25 million barrels below the seasonal average as diesel cracks outperform all other products.

Finland Gas Leak Raises the NordStream Specter. Finland’s Gasgrid confirmed that external marks were found along a gas pipeline and a data cable connecting Finland and Estonia, with the operator expected to take at least five months for repairs, sending TTF gas prices to €53 per MWh.

Saudi Aramco Eyes Another Chinese Farm-In. Saudi national oil company Saudi Aramco (TADAWUL:2222) is reportedly in talks to purchase a 10% stake in Shandong Yulong Petrochemical, a 400,000 b/d refinery that is currently being built and could lock in a term supply agreement.

Mozambique LNG Nears Final Investment Decision. Italian oil major ENI (BIT:ENI) plans to reach a FID on its second floating LNG project in Mozambique by mid-2024, with the additional ship assumed to produce 3.5 mtpa of liquefied gas and to be operational within four years.

Canada Confronts TMX Headache. Canada’s government might not fully recoup the $26 billion that it invested into the soon-to-be 890,000 b/d Trans Mountain Pipeline connecting Alberta to the country’s Pacific Coast, as its plans to sell its stake after the pipeline’s launch have seen very limited interest from pipeline operators.

Iraq Prepares Turkmenistan-Iran Gas Swap. Iraq might be buying up to 10 bcm per year of natural gas from Turkmenistan despite not having a shared border, with Turkmen gas flows administered under a swap arrangement through neighboring Iran.

Thanks for reading and we’ll see you next week.

Michael Kern,

Oilprice.com

Comentarios