OIL PRICE INTELLIGENCE REPORT

In today’s newsletter, we will take a quick look at some of the critical figures and data in the energy markets this week.

We will then look at some of the key market movers early this week before providing you with the latest analysis of the top news events taking place in the global energy complex over the past few days. We hope you enjoy.

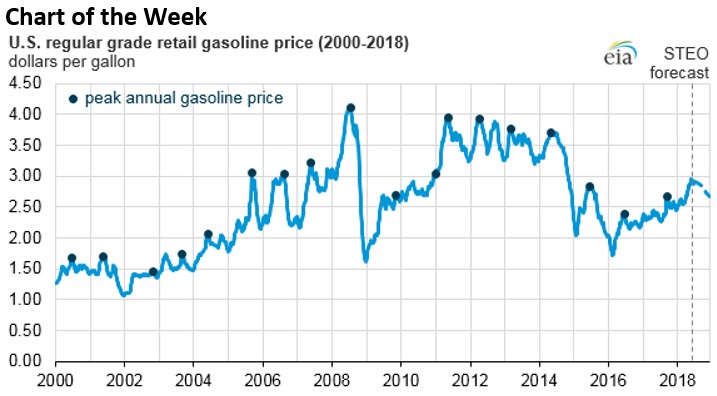

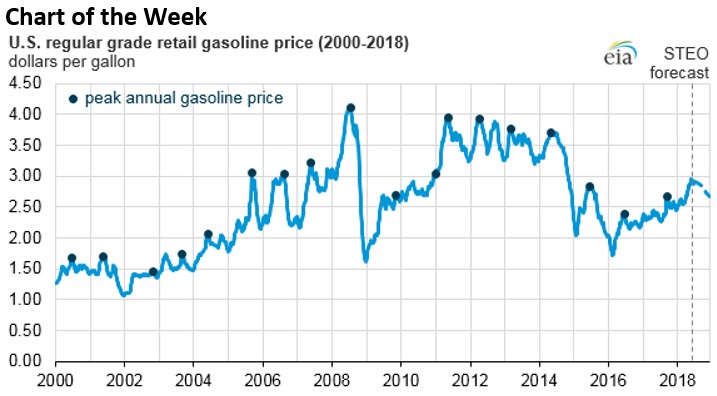

- The EIA predicts that gasoline prices in the U.S. have already peaked and will gradually decline over the course of 2018. The high point was in late May when the national average hit $2.96 per gallon. The EIA notes that gasoline prices tend to peak in the summer when demand is at its strongest point and more expensive summer fuel blends are required.

- The EIA expects gasoline prices to fall to $2.84/gallon by September and to $2.68/gallon by December.

- However, the short-term outlook seems to ignore the growing number of crude oil supply outages around the world, which is driving up oil prices.

- There is always a several month lag between changes in oil prices and changes in prices at the pump. But WTI is back to a three-year high, which likely means that gasoline prices are set to rise in the coming weeks, defying the EIA forecast.

Market Movers

- The state of Rhode Island is suing several oil majors over their role in fueling climate change, which is damaging the state’s coastline. The lawsuit targets ExxonMobil (NYSE: XOM), BP (NYSE: BP), Royal Dutch Shell (NYSE: RDS.A) and Chevron (NYSE: CVX).

- Laredo Petroleum (NYSE: LPI) reiterated its production guidance for this year (10 to 12 percent growth) after a fire at its storage tank in Texas. The shut-in production that was affected by the fire will be restored.

- BP (NYSE: BP) said it began operations at the $28 billion Shah Deniz 2 gas pipeline in Azerbaijan to supply gas to Turkey and to other parts of Europe. The project is the first subsea development in the Caspian Sea.

Tuesday July 3, 2018

Oil prices surged in early trading on Tuesday as the supply outages in Libya began to take center stage, but Saudi Arabia and Russia quickly moved to calm markets. The loss of 850,000 bpd nearly offsets all of what OPEC+ plans on adding to the market, although it remains to be seen how high Saudi Arabia plans on going unilaterally. For now, the oil market is looking tighter by the day, and Brent is within striking distance of $80 per barrel.

OPEC production rises in June. Saudi Arabia ramped up production in June ahead of the OPEC+ meeting, pushing the group’s overall output to 32.32 million barrels per day (mb/d), according to Reuters, an increase of 320,000 bpd from May. That puts OPEC’s production level at its highest point since January 2018. The increase came from a massive increase in production from Saudi Arabia, which pushed output close to a record high at 10.70 mb/d. The enormous increase of from May levels from Saudi Arabia was offset by outages in Libya and declines in Venezuela. “We are entering the second half of the year with a huge amount of uncertainty surrounding the supply side of the equation,” Tamas Varga of oil broker PVM, told Reuters. “Depending on your belief you could just as easily bet on $100 as $60 by the end of the year.”

Oil dips on Monday on Trump tweet, rises on Tuesday. Over the weekend President Trump tweeted that OPEC would add 2 mb/d of new supply, a statement that confused the oil market. The White House had to walk back that comment, issuing a statement that said that the Saudi King merely told Trump that there was 2 mb/d of spare capacity that could be called upon if needed. Nevertheless, Trump’s tweet led to a dip in oil prices on Monday as traders tried to figure out if Saudi Arabia planned on adding more oil than expected. In early trading on Tuesday, however, it seemed that expectations of a wave of supply subsided, with traders refocusing on the outages in Libya and Canada. WTI and Brent jumped more than 1 percent in early trading before falling back again.

Caribbean refinery to restart ahead of IMO regulations. An old shuttered refinery on the island of St. Croix will restart operations in 2019, leading to the production of 150,000 bpd of low-sulfur fuels ahead of sulfur regulations from the International Maritime Organization that take effect in 2020.

Conoco on temporary retreat from Permian. ConocoPhillips (NYSE: COP) is redeploying assets away from the Permian to other shale basins as the West Texas shale fields have become too crowded and takeaway capacity is all but maxed out. “Production has come on quicker in the Permian Basin, because the rigs were ramped up a lot faster than we would have thought maybe a year or a year and a half ago,” Conoco CEO Ryan Lance told the FT. “We have other opportunities to go spend our capital,” Lance said. “And I am not sure it makes sense to drill into that headwind.” Still, he noted that the pause on Conoco’s activity in the Permian will be temporary.

Libya loses 850,000 bpd because of port outages. The internal battle for control of Libya’s main crude oil export terminals has led to the National Oil Corp. to declare force majeure on loadings from the Zueitina and Hariga ports on Monday, leading to the disruption of 850,000 bpd. The sudden outage sent shockwaves through the oil market. “Oil bulls seem to have returned after Libya suspended oil exports from two key ports,” Hussein Sayed, chief market strategist at futures brokerage FXTM, told Reuters. “If Libya’s oil doesn’t return fast to the market it will be an important test to OPEC’s spare capacity, especially given that output from Venezuela and Iran is expected to fall significantly in the next couple of months,” he added.

Steep backwardation for WTI. The outage of 360,000 bpd from Syncrude Canada has led to a spike in WTI prices, raising fears of adequate short-term supply. The outage has also led to a sharp narrowing of the WTI discount relative to Brent, forcing the two benchmarks to converge. Moreover, the front-month WTI futures contract is now trading at an incredible $2-per-barrel premium to WTI two months out. The steep backwardation is an indication of market tightness.

Morgan Stanley hikes oil price forecast by $7.50 per barrel. Morgan Stanley increased its forecast for Brent oil prices by $7.50 per barrel to $85, on expectations of more outages from Angola, Iran and Libya. The investment bank is holding an $85-per-barrel target for the next 12 months.

Russia stepping up oil production. Russian oil companies are “priming the pumps to significantly boost crude output this summer,” according to the Wall Street Journal. Russia suggested it could add 200,000 bpd from current levels, although independent estimates of what Russia can achieve vary.

Iran sees widespread protests. Protests have erupted again on Iranian streets, as economic and political grievances mount. The Trump administration is trying to tighten the noose by cutting down Iranian oil exports, but much of the discontent is homegrown. There is disagreement over whether aggressive confrontation from the U.S. will weaken or strengthen hardliners in the Iranian regime.

Tesla hits production milestone. Tesla (NASDAQ: TSLA) finally hit its production goal of 5,000 Model 3 units per week. Elon Musk said output would rise to 6,000 per week in July. “I think we just became a real car company,” Musk wrote in an email to employees.

We will then look at some of the key market movers early this week before providing you with the latest analysis of the top news events taking place in the global energy complex over the past few days. We hope you enjoy.

- The EIA predicts that gasoline prices in the U.S. have already peaked and will gradually decline over the course of 2018. The high point was in late May when the national average hit $2.96 per gallon. The EIA notes that gasoline prices tend to peak in the summer when demand is at its strongest point and more expensive summer fuel blends are required.

- The EIA expects gasoline prices to fall to $2.84/gallon by September and to $2.68/gallon by December.

- However, the short-term outlook seems to ignore the growing number of crude oil supply outages around the world, which is driving up oil prices.

- There is always a several month lag between changes in oil prices and changes in prices at the pump. But WTI is back to a three-year high, which likely means that gasoline prices are set to rise in the coming weeks, defying the EIA forecast.

Market Movers

- The state of Rhode Island is suing several oil majors over their role in fueling climate change, which is damaging the state’s coastline. The lawsuit targets ExxonMobil (NYSE: XOM), BP (NYSE: BP), Royal Dutch Shell (NYSE: RDS.A) and Chevron (NYSE: CVX).

- Laredo Petroleum (NYSE: LPI) reiterated its production guidance for this year (10 to 12 percent growth) after a fire at its storage tank in Texas. The shut-in production that was affected by the fire will be restored.

- BP (NYSE: BP) said it began operations at the $28 billion Shah Deniz 2 gas pipeline in Azerbaijan to supply gas to Turkey and to other parts of Europe. The project is the first subsea development in the Caspian Sea.

Tuesday July 3, 2018

Oil prices surged in early trading on Tuesday as the supply outages in Libya began to take center stage, but Saudi Arabia and Russia quickly moved to calm markets. The loss of 850,000 bpd nearly offsets all of what OPEC+ plans on adding to the market, although it remains to be seen how high Saudi Arabia plans on going unilaterally. For now, the oil market is looking tighter by the day, and Brent is within striking distance of $80 per barrel.

OPEC production rises in June. Saudi Arabia ramped up production in June ahead of the OPEC+ meeting, pushing the group’s overall output to 32.32 million barrels per day (mb/d), according to Reuters, an increase of 320,000 bpd from May. That puts OPEC’s production level at its highest point since January 2018. The increase came from a massive increase in production from Saudi Arabia, which pushed output close to a record high at 10.70 mb/d. The enormous increase of from May levels from Saudi Arabia was offset by outages in Libya and declines in Venezuela. “We are entering the second half of the year with a huge amount of uncertainty surrounding the supply side of the equation,” Tamas Varga of oil broker PVM, told Reuters. “Depending on your belief you could just as easily bet on $100 as $60 by the end of the year.”

Oil dips on Monday on Trump tweet, rises on Tuesday. Over the weekend President Trump tweeted that OPEC would add 2 mb/d of new supply, a statement that confused the oil market. The White House had to walk back that comment, issuing a statement that said that the Saudi King merely told Trump that there was 2 mb/d of spare capacity that could be called upon if needed. Nevertheless, Trump’s tweet led to a dip in oil prices on Monday as traders tried to figure out if Saudi Arabia planned on adding more oil than expected. In early trading on Tuesday, however, it seemed that expectations of a wave of supply subsided, with traders refocusing on the outages in Libya and Canada. WTI and Brent jumped more than 1 percent in early trading before falling back again.

Caribbean refinery to restart ahead of IMO regulations. An old shuttered refinery on the island of St. Croix will restart operations in 2019, leading to the production of 150,000 bpd of low-sulfur fuels ahead of sulfur regulations from the International Maritime Organization that take effect in 2020.

Conoco on temporary retreat from Permian. ConocoPhillips (NYSE: COP) is redeploying assets away from the Permian to other shale basins as the West Texas shale fields have become too crowded and takeaway capacity is all but maxed out. “Production has come on quicker in the Permian Basin, because the rigs were ramped up a lot faster than we would have thought maybe a year or a year and a half ago,” Conoco CEO Ryan Lance told the FT. “We have other opportunities to go spend our capital,” Lance said. “And I am not sure it makes sense to drill into that headwind.” Still, he noted that the pause on Conoco’s activity in the Permian will be temporary.

Libya loses 850,000 bpd because of port outages. The internal battle for control of Libya’s main crude oil export terminals has led to the National Oil Corp. to declare force majeure on loadings from the Zueitina and Hariga ports on Monday, leading to the disruption of 850,000 bpd. The sudden outage sent shockwaves through the oil market. “Oil bulls seem to have returned after Libya suspended oil exports from two key ports,” Hussein Sayed, chief market strategist at futures brokerage FXTM, told Reuters. “If Libya’s oil doesn’t return fast to the market it will be an important test to OPEC’s spare capacity, especially given that output from Venezuela and Iran is expected to fall significantly in the next couple of months,” he added.

Steep backwardation for WTI. The outage of 360,000 bpd from Syncrude Canada has led to a spike in WTI prices, raising fears of adequate short-term supply. The outage has also led to a sharp narrowing of the WTI discount relative to Brent, forcing the two benchmarks to converge. Moreover, the front-month WTI futures contract is now trading at an incredible $2-per-barrel premium to WTI two months out. The steep backwardation is an indication of market tightness.

Morgan Stanley hikes oil price forecast by $7.50 per barrel. Morgan Stanley increased its forecast for Brent oil prices by $7.50 per barrel to $85, on expectations of more outages from Angola, Iran and Libya. The investment bank is holding an $85-per-barrel target for the next 12 months.

Russia stepping up oil production. Russian oil companies are “priming the pumps to significantly boost crude output this summer,” according to the Wall Street Journal. Russia suggested it could add 200,000 bpd from current levels, although independent estimates of what Russia can achieve vary.

Iran sees widespread protests. Protests have erupted again on Iranian streets, as economic and political grievances mount. The Trump administration is trying to tighten the noose by cutting down Iranian oil exports, but much of the discontent is homegrown. There is disagreement over whether aggressive confrontation from the U.S. will weaken or strengthen hardliners in the Iranian regime.

Tesla hits production milestone. Tesla (NASDAQ: TSLA) finally hit its production goal of 5,000 Model 3 units per week. Elon Musk said output would rise to 6,000 per week in July. “I think we just became a real car company,” Musk wrote in an email to employees.

Comentarios