OIL & ENERGY INSIDER

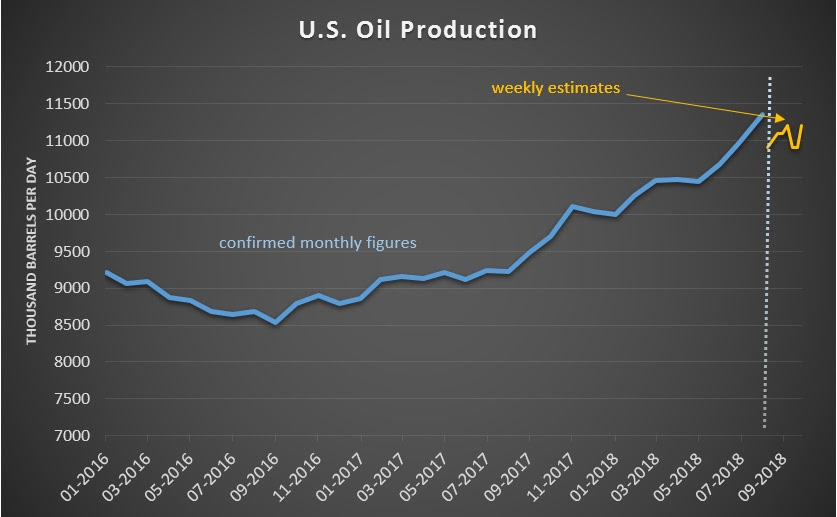

Oil prices continued to slide on Friday afternoon, despite a small decline in the U.S./Canadian rig count.        Friday, November 2, 2018 Iran sanctions are just days away but the market has come around to the idea that Iranian oil exports won’t be going to zero, despite months of promises from the Trump administration. New reports suggest waivers are in the offing. “Oil prices look to remain under pressure, as fears of global oversupply have returned with a vengeance,” Ashley Kelty, oil and gas research analyst at Cantor Fitzgerald Europe, told Reuters. U.S. to grant waivers to eight countries importing Iranian oil. The U.S. has granted exemptions to eight importers of Iranian oil just days before sanctions on Iran take effect. The countries will be allowed to continue to import oil without fear of retribution from the U.S. as long as they continue to make reductions in those purchases, according to Bloomberg. Four of the countries include Iran’s top buyers – China, India, South Korea and Japan. The other four were not identified in the Bloomberg report, but the decision is expected to be announced on Monday. U.S. oil production surges. The EIA said the U.S. produced more than 11.3 mb/d in August, a massive jump of over 400,000 bpd from a month earlier. The new record high also made the U.S. the largest oil producer in the world. Record output, combined with higher production from OPEC, has dealt sharp losses to crude oil prices amid mounting fears of oversupply. Trump's admin sees “thaw” in relations with China. President Trump spoke with Xi Jingping by phone on Thursday, and Trump tweeted that the discussion went well. His economic adviser Larry Kudlow said that there was a “thaw” in relations. The two leaders are expected to meet later this month at the G20 summit in Argentina, and the conversation by phone this week raises the odds of a breakthrough on trade. Crucially, Bloomberg reports that Trump wants to reach a deal with Xi in Argentina, and he reportedly asked his cabinet to draft terms. However, hours after the phone call, the U.S. Justice Department unveiled charges against two Chinese companies for intellectual property theft, illustrating the difficult task of resolving differences between the two countries. U.S. seeks to keep Middle East oil flowing. U.S. diplomats have reportedly stepped in to try to resolve disputes in the Middle East to increase oil flows. According to the Wall Street Journal, the U.S. is trying to broker a deal between Saudi Arabia and Kuwait over the Neutral Zone oil fields, which have 500,000 bpd of capacity but have been offline for years. The U.S. is also trying to help Iraq export more oil through Kurdistan, which would add another 300,000 bpd or so to global supplies. Washington is trying to ease these burdens at a time when it is seeking to shut in Iranian production. EOG posts $1.2 billion in profit. EOG Resources (NYSE: EOG) posted an enormous $1.2 billion in third quarter profit, up more than ten-fold from the $100 million profit a year earlier. The performance is a strong vote of confidence in shale drilling, after years of red ink across the industry. Continental Resources doubles resource estimate. Continental Resources (NYSE: CLR) doubled its estimated recoverable resources to 30-40 billion barrels, up from the previous estimate of 20 billion barrels set in 2011. “With today's completion technology we are recovering 15% and potentially 20% of the oil in place on a primary basis,” Continental’s President Jack Stark said during today's earnings conference call. “This is substantially higher than the recoveries that we thought possible back in 2011.” Tanker rates up on higher OPEC production. Tanker rates are rising as OPEC ships more oil, pushing day-rates up to $51,000, up nearly three-fold from the $18,000 rates seen just a month ago. Oil and gas sector needs consolidation. Top industry executives said that the oil and gas industry needs to consolidate, in order to reach scale, cut costs and streamline services. “There's a lot of smaller high-quality companies across industry where synergy and value can be captured” by combining, Chesapeake Energy’s (NYSE: CHK) CEO Doug Lawler said at the Deloitte Oil & Gas Conference, according to S&P Global Platts. “This will be a part of [Chesapeake's] strategy going forward.” Other top analysts and executives voiced similar sentiments, an indication that a new wave of M&A activity could be coming. Petrobras could divest $20 billion. New Brazilian President Jair Bolsonaro has indicated he would not privatize Petrobras for now, but the company might still divest itself of some $20 billion worth of assets, according to a source for Reuters. Economists: Brent to average $76 in 2019. A Reuters survey of 46 economists find an averaged predicted Brent crude price of $76.88 per barrel in 2019. The respondents see Iran sanctions putting a floor beneath oil prices, but weaker demand and a slower global economy putting a cap on prices. OPEC production hits two-year high. OPEC production rose in October to its highest level in nearly two years. Higher output from Saudi Arabia, Libya and the UAE pushed production up 390,000 bpd compared to September’s levels. The figures gave the market confidence OPEC will be able to supply the market as Iranian production goes offline. Oil majors post huge earnings. The third quarter earnings for the oil majors were the strongest in years, with a significant jump in profits. Cost-cutting and higher oil prices led to a windfall for the world’s largest oil companies. Most of them are sticking with a plan of capital discipline, with an emphasis on boosting shareholder returns. Venezuela’s refinery utilization plummets, leading to fuel shortages. Venezuela’s refineries are operating at low levels as the nation runs short on crude oil. Refineries have averaged a meager 17 percent utilization rate this year, according to Bloomberg, down from 50 percent last year and 70 percent in 2016. Gas shortages have spread quickly and there is no end in sight for the crisis. Thanks for reading and we’ll see you next week. Best Regards, Tom Kool Editor, Oilprice.com P.S. – We are excited to announce in the past few weeks the Oilprice community has grown over 50%, becoming one of the largest most active energy communities on the internet. Join the discussion now and have your say! |

|

| You have probably seen and read dozens of articles foretelling the impending fall of the Maduro regime in Venezuela. A civil war brought about by the populace’s pauperization and dearth of everything, a traditional Latin American coup d’etat organized the increasingly powerful Venezuelan military etc. – the scenarios are manifold, but we pretty much agree on the outcome. So far, all these predictions have sprung to life but that is not because they are founded on incorrect premises, more like the Venezuelan government becoming ever-flexible to prolong its rule for another couple of months or years. In the meantime, as we speak about Iran sanctions, Russia and Saudi Arabia wanting to institutionalize OPEC+ and other relevant issues, Venezuela is sinking ever lower. According to Kpler data, loadings from Venezuela in the first two decades of October were down to 0.99 mbpd, falling some 300 kbpd from September 2018 alone. Even if we are to allow some space for inaccuracies and the difficulty of tracking all flows correctly, all data sources point to the same trend – if in the beginning of 2018 the average weekly loading volume oscillated between 10 and 12 million barrels, now it moves strictly within 6-7 million barrels. To put it into blunter terms, Venezuela’s production volume has fallen back 70 years to 1940s levels. Oil workers in Venezuela have to cope with problems completely unknown or forgotten by energy specialists elsewhere – malnutrition, lack of pharmaceuticals and basic foodstuffs. Graph 1. Venezuela’s Oil Production.  The downfall would have been even more drastical, were it not for the PDVSA-ConocoPhillips settlement this August. The row dates back to the nationalization of Conoco assets, which, as the International Chamber of Commerce has concluded, was illegal and had to compensated for by the Venezuelan side ($2 billion). Without any other way of enforcing the decision, ConocoPhillips tried to seize PDVSA’s assets in Aruba, Bonaire and Curacao, which the Venezuelan company uses for storage and blending operations. Until the dispute was adjusted, PDVSA could not use its Caribbean facilities, adversely affecting its operations – the quality of the crude it exported deteriorated palpably, port congestions in Venezuelan ports became nightmarish and loading delays routine-like. There were talks about Venezuela even declaring force majeure on its exports, many tankers contained up to 10 percent hydrogen sulphide and way too much water and basic sediment. The settlement has eased Caracas‘ problems as PDVSA brought back online its 335 kbpd Isla refinery in Curacao – in fact, Curacao and Aruba are the only destinations worldwide which have been rising in the last three months. Yet simultaneously with one single positive development, Venezuela witnessed a string of unforeseen problems that have hampered its potential further. Blackouts have been hindering oil productions for quite some time, yet now they became national and take several days to end. For instance, a fire on a 230kV power transmission system near the city of Maracaibo has led to an almost month-long blackout in Zulia state, where the PDVSA produces around 300kbpd of oil equivalents. You would think things like this are a one-off occasion, but not in Venezuela. Exactly two months later, twelve Venezuelan states were caught in a blackout that switched off some 300-400kbpd of production and also caused disruptions at the 940kbpd Paraguaná refinery. Predictably, the Venezuelan authorities blamed saboteurs for the damage caused, yet the omnipresent lack of finances is straining the country’s already shattered infrastructure. Even before the blackouts and fires, the state of Zulia and others experienced electricity rationing as their thermal power plants generally function at 10-15 percent of nominal capacity. Add to this an unprecedented exodus of skilled workers and you have a perfect storm coming your way. The employment of unskilled and barely paid workers can now be evidenced by the frequency of major accidents taking place in Venezuela’s refineries and ports. First a vessel carrying naphtha from the United States rammed the south pier of the Jose terminal, accounting for around 50 percent of Venezuela’s crude exports and a hefty share of its naphtha imports, too. The pier is still closed, severely limiting Venezuela’s possibilities to dilute crude with the naphtha it imports. PDVSA’s last communication indicated the Jose terminal pier should be ready by November, but do not trust it any more than reading tea leaves, the national oil company delayed it for the fifth time already, so the repair works will definitely continue for quite some time. Graph 2. Venezuela’s Oil Infrastructure.  Source: OECD/IEA. That is still not the whole picture - Petromonagas, a joint venture of the Russian NOC Rosneft and PDVSA, has cancelled four cargoes mid-October as it was forced to shut down its crude upgrader due to technical problems. Thus, Venezuela is in big trouble now to pump out any diluted crude oil (DCO) to the global markets, even though a mere four months ago PDVSA officially reconfirmed its commitment to export an average of 500 kbpd DCO every month. And to make matters worse, Venezuela’s last lifeline these past few years are loans from politically friendly nations, mostly from China and Russia. Under these loans Venezuela is to repay the required sum in oil – as you can deduct from the above, against the background of dysfunctional infrastructure and damaged port facilities, PDVSA is struggling to meet its commitments. Understandably, Moscow and Beijing prefer not to sit idly and both Chinese and Russian political delegations have visited Venezuela this week to discuss ways of breaking the impasse. The Russians concentrated more on financial matters in bilateral relations and paths of overcoming delays in PDVSA paying back its debt to Rosneft. The Chinese, however, are the single most important partner of Venezuela, cherished by the Maduro regime, not least because it still has to pay back $23 billion from the $55 billion it had borrowed since 2007. The Chinese conducted a review of Venezuela’s energy strategies to determine whether Caracas should receive another loan, this time a $5 billion one that would, according to preliminary information, be spent on joint ventures in upstream. Venezuela desperately needs the Chinese loan; PDVSA has defaulted on all its debt except the abovementioned ConocoPhilips settlement (which it will inevitably fail to fulfill) and a 2020 Citgo bond release. Yet the Chinese are tricky negotiators – given their heavy presence in Venezuela and their palpable influence in creating the country’s energy policy, one would think they take in a lot of Venezuelan crude. Yet only 22 percent of Venezuela’s exports end up in China, even India takes in more now (all the more so the U.S., which accounts for one third of its exports) – falling almost 20 percent year-on-year. Chinese teapot refiners could have gone with Venezuelan Merey, yet opted for Western Canadian Select, an even more sulphurous yet lighter grade, due to the massive double-digit premiums Canada displays now. China will increase its intake of Venezuelan crude after construction season ends in December-January and Sulphur becomes an issue to be looked into once again, Venezuela will repair if not all of its damaged infrastructure sites, than at least the most important ones and will bounce back from the low point it currently experiences. It will return to some 1.2 mbpd of oil output, but only temporarily. It might seem that Venezuela is going through a streak of bad luck and that if a country possesses the largest proved oil reserves on the planet, they ought to be exploited one way or another – looking at the big picture, however, shows that the Maduro government’s attempts to wrest out more time in power are just small patches, not structural moves that can reverse the nation’s fortunes. In less than three years, Venezuela’s production has halved from the 2.35 mbpd attained in January 2016. The IEA reckons that Venezuela’s production is still yet to bottom out and that it would happen in the mid-2020s (after that it expects a rebound to 2.5 mbpd by 2040). That means that the Paris-based organization anticipates a gradual disintegration of Venezuela’s oil sector. The Trump Administration, of course, is eager to speed things up when it comes to regime change in Venezuela, mulling a new round of sanctions which could ban US product imports to Venezuela, which are being currently used to dilute heavy Venezuelan crude. Amid the shocking details of the $1.2 billion money-laundering case currently reviewed in Miami, involving money laundering, fraud and exchange rate machinations, Venezuela’s prospects are the epitome of gloom. Now the last thing the tormented Venezuelan nation needs is the military stealing the show. |

Comentarios